Moneyball for pensions

by Doug Brodie

In this blog:

/1. The $12.5 million idea

/2. Moneyball for pensions

/3. We are data analysts

/4. Good recipe, but what’s the cake like?

/5. So long, farewell

/6. And Alan did run

/7. Almost Methuselah

Moneyball is based on assessing the likely competency of players within your baseball team; what the economist Peter Brand did was to break down all the statistics of a player’s game, cross reference them to other players, and work out a cash value for each to enable the team, the Oakland Raiders, to buy the best ability for the lowest buck.

/1. The $12.5 million idea

I don’t know anything about baseball (how come a ‘world’ series is only in America??), however, John Henry does – he owns the Boston Red Sox, the Pittsburgh Penguins as well as our own Liverpool football club; his assessment of Brand’s idea is outlined by Wikipedia:

The owner of the Boston Red Sox, John W. Henry, realizes that sabermetrics is the future of baseball. He makes Beane an offer to become the Red Sox general manager for a $12.5 million salary, which would make him the highest-paid general manager in sports history.

/2. Moneyball for pensions

If you read anything about investing, and have had conversations with well-intentioned advisers, you’ll have heard the common refrain:

Investing is for the long term and should only be used and measured over five years.

If that’s so, how come the same commentary talks about asset allocation for the coming year (that’s 12 months to you and me)? That suggests the person talking to you has an idea of what’s likely to happen over the next year. We think that’s simply wrong – for the markets to exist there cannot be that level of predictability.

/3. We are data analysts.

This is Kseniia, our lead analyst who came to us from Ukraine, her full-time job, Monday to Friday, all day every day, is breaking down investment numbers and tracking trends through graphs, charts and sensitivity tables.

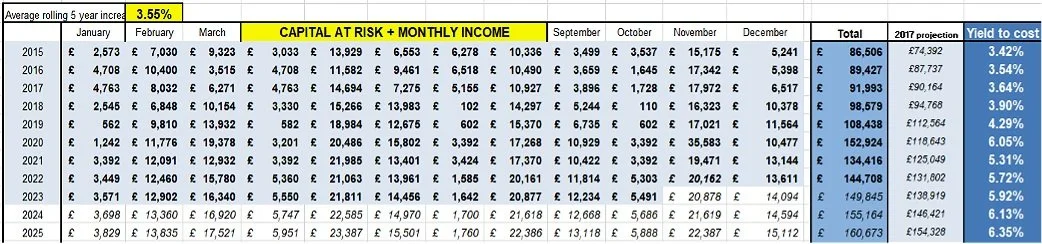

This is the type of table where Kseniia is happiest, and this is the type of data that you and I will never find anywhere else. It is hacking the statistics to measure what has been happening with an investment to make an informed decision about the values for the coming years:

IT’S NOT THE CAPITAL!!

The decisions we are making are NOT about the likelihood of future capital values – we don’t believe that can be done. We have seen, however, that income is trackable, auditable, and able to be projected, and using investment trusts, we know what cash is already there. It’s like playing blackjack where the banker tells you upfront what cards he’s drawn.

Firstly, here’s where F&C’s dividends for next year are already stored:

You can see the annual dividend in the table above, last year it was £68.9 million, and it has reserves of £97m in income, and £4.2 billion in capital – that’s £4.3 billion to support an annual dividend payment of £69 million: the dividend is not contractual, it’s not ‘guaranteed’, however, we think those resources show probability is on your side, n’est-ce pas?

/4. Good recipe, but what’s the cake like?

An uncomfortable thing about income investing is that for us – the adviser – there’s nowhere to hide – the income is either there or it’s not, we can’t blame the markets for a retiree not having the requisite income. In 2014 we organised a portfolio covering £2.5 million for a married couple, two ISAs, two SIPPs and an offshore bond. We set up a projection table for twenty years, until the lead client is 60, the intended retirement age.

The projection table identifies the income not just per year, but for each month. Here are the actual results, alongside what the amended 2017 projection indicated:

This year’s income – subject to November & December reconciliations – will be £149,845, and the projection we originally plotted for 2023 was £138,919. In fact, in every single year you can the actual income exceeded the projection. That’s not luck, it’s not rocket science, it’s not smoke and mirrors – we deliberately round down income, and we deliberately use portfolios where (our data analysis tells us) the confidence level of payment is 100%, and the confidence level of an increase in payment is 97% (measured from 1986 to 2022).

We do this for every client, this is the reason why every client comes into the firm via the financial planning analysis.

/5. So long, farewell.

We’ve lost a few friends, some closer than others, and these recent folk whose lives were textbook lessons on carpe diem.

In the words of Private Eye...

Farewell then Ian Baker

He lived all his 85 years

By squeezing them into just 59

His hours had 70 minutes, where ours have 60.

Ian was a friend of the company, a friend of ours and husband of our head of compliance. A technical engineering specialist who was on call to Rolls Royce Aero, BAe Systems, Williams F1 – when their engineering spindles broke, it had to be absolutely Ian Baker called in to fix them, downtime was too costly otherwise. Ian was a man who made you feel out of breath just standing beside him, whose day would range from responsibility for installing a £5m machine in Derby then organising a hand-designed, solar-controlled, house for his five tortoises. Ian was a man who never ran, but it was hard to keep up with him. He’ll be missed.

/6. And Alan did run.

Alan was a client who died at 91, if you’d ever look up the word ‘sprightly’ in the dictionary you’d see his face. Sprightly is probably underplaying it though – Alan did run, though he was a late starter, first pounding the pavements at 50, and then he celebrated his 80th birthday by running a 10k race.

Alan was the father of one of our directors; he was six months younger than my mother, and celebrated having the same cause of death recorded on his death certificate as the Queen:

He was of that generation that for me was like talking to my Dad, who died eighteen years ago, so it was fascinating listening to his tales of youth during the war years. In 1949, after he had finished school he and a chum decided to go hitchhiking across Europe – I can only wonder about how he explained that to his parents. This was Europe less than four complete years since WW2 had finished. He covered the low countries (as they were known), and out across to Italy, then downwards. He said the hitching was always pretty straightforward as they just hopped on to the lorries of the various armies that were still running the places then, though as 18/19-year-old males, he said they had to be careful not get rounded up as deserters or pulled in as spies.

Thanks Alan – there’s not a chance my wife will forget that a 10k run to celebrate being 80 is the target you have set! Alan was one of those people where you seriously wanted to download all his memories and adventures onto a USB drive so you could watch his life at leisure. He will be missed.

/7. Almost Methuselah

Beside Warren Buffett was Charlie Munger – a lawyer by profession, who joined Mr Buffett as a partner in Berkshire Hathaway, yet another billionaire who made every penny of his wealth through investing, not making. Warren is and was the frontman of the partnership, most clearly seen at the annual meetings for shareholders – when Warren answered questions from shareholders he would invariably round off his answer by passing the question on to Charlie, sat beside him, whose answer would just be ‘I have nothing to add’. Charlie died at 99. Warren says that Charlie was the person responsible for the underlying strategy that made Berkshire so successful, by shifting away from Warren’s buying troubled companies at cheap prices to buying high-quality companies at fair prices.

Do as he said, it certainly worked:

I think the reason why we got into such idiocy in investment management is best illustrated by a story that I tell about the guy who sold fishing tackle. I asked him, 'My God, they're purple and green. Do fish really take these lures?' And he said, 'Mister, I don't sell to fish.'

Live within your income and save so that you can invest. Learn what you need to learn.

A lot of people think that if they have a hundred stocks they’re investing more professionally than they are if they have four or five. I regard this as insanity.

The world is full of foolish gamblers and they will not do as well as the patient investors.

In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time — none, zero. You’d be amazed at how much Warren reads — and at how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.

I find it much easier to find four or five investments where I have a pretty reasonable chance of being right that they're way above average. I think it's much easier to find five than it is to find 100. I think the people who argue for all this diversification — by the way, I call it ‘deworsification’ — which I copied from somebody — and I'm way more comfortable owning two or three stocks which I think I know something about and where I think I have an advantage.

If you’re going to invest in stocks for the long term or real estate, of course there are going to be periods when there’s a lot of agony and other periods when there’s a boom. And I think you just have to learn to live through them. As Kipling said, treat those two imposters just the same. You have to deal with daylight and night. Does that bother you very much? No. Sometimes it’s night and sometimes it’s daylight. Sometimes it’s a boom. Sometimes it’s a bust. I believe in doing as well as you can and keep going as long as they let you.

Mimicking the herd invites regression to the mean (merely average performance).

Understanding both the power of compound interest and the difficulty of getting it is the heart and soul of understanding a lot of things.

We now have computer algorithms trading with other computers. And people buying stocks who know nothing, being advised by people who know even less. It’s an incredibly crazy situation...All this activity makes it easier for us.

There are huge advantages for an individual to get into a position where you make a few great investments and just sit on your ass: You are paying less to brokers. You are listening to less nonsense. And if it works, the governmental tax system gives you an extra 1, 2 or 3 percentage points per annum compounded.

We’ve had enough good sense when something is working very well to keep doing it. I’d say we’re demonstrating what might be called the fundamental algorithm of life — repeat what works.

All I want to know is where I’m going to die, so I’ll never go there. And a related thought: Early on, write your desired obituary — and then behave accordingly.

Quite.