CHANCERY BRAIN

Investing shorts

In this blog:

Getting your pension right first time

Damn teenagers, always on their phone! (So are you, here’s the proof).

Everyone is normal – here’s a family story about money.

In this blog:

Annuity rates, and that 20% per year.

If you’re considering an annuity, is it cheaper to self-insure your pension income?

Ten Years After – not the Nottingham band, it’s the tales of 10 people who retired 10 years ago. Regrets? They’ve had a few.

Yale Research on ageing: how to live 71/2 years longer, actionable insights.

In this blog:

‘My absolute superpower in work and life is …’

Regrets? I've had a few – even though I've worked in finance

In this blog:

The Penshurst Place Problem

The reality: a 50ft garden and a dog with opinions

The pension admin confession (don’t tell Doug)

Why it’s so hard to care about your future self

The fantasy lifestyle I’m saving for (kind of)

The ending I’m working towards

In this blog:

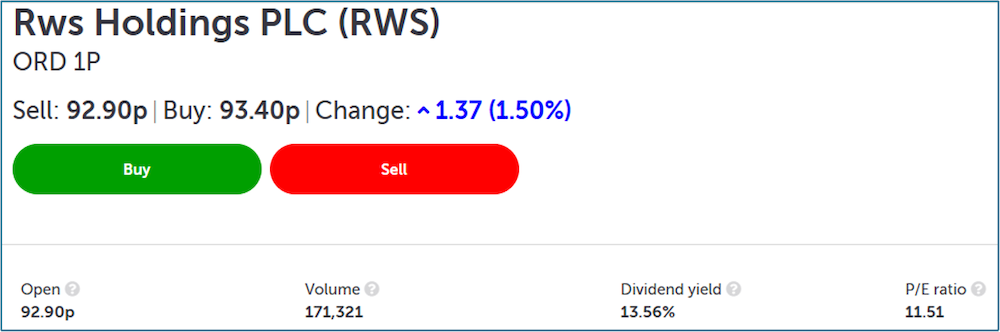

The Yield Illusion

Gold will go up, down or sideways this year

Who’s buying at this level? Keep pumping your trackers

Easy money, daily habits

Do what frightens you: here I come, ready or not

In this blog:

Is it debt or credit?

Why the 4% Rule doesn’t work in the UK.

You’ve done some things, but have you done this?

You’re a long time dead

AI, The Vietnam War and Watergate.

The financial independence you have successfully achieved for yourself and spouse is best rewarded with experience, events, places and people, so in today’s Investing Short, we cherry-pick some suggestions for every month of next year.

In this blog:

Gertcha!

Are you rich? Êtes-vous riche?

It's getting hard to tell gambling from investing

Looking at a trust: Temple Bar

This is important if you want to be relaxed

Annuity rates at 9th December

In this blog:

Can you play tennis?

How does a trust work, is it that simple and what’s the difference between the ‘majors’?

Have we reached Peak 65? Not old, ‘older’?

Look at a trust: why we love Law Debenture

Fancy some crypto? How to lose your shirt, or, what they don’t tell you.

In this blog:

1. 10 year discrete returns – the FTSE index vs the active sectors, can you spot a trend?

2. Retiring – what you’re supposed to be doing.

3. What was born in 1960, costs £2.3m and you use it to thrash around a race track?

4. Lucky – this is you and me.

In this blog:

1. Top trusts for income.

2. The last time this happened.

3. We invest in preparedness, not in prediction (you should to).

4. Our story - ever wondered who we are and how Chancery Lane got here?

In our 2025 White Paper, we provide empirical evidence, not just opinion, on how advisers can deliver reliable, inflation-resilient drawdown income for their clients.

Request your free copy here.

In this blog:

In the 70’s and 80’s Japanese commercial businesses and large scale engineering were globally dominant alongside the US. As incompetence drove the UK car industry into dust, so Toyota and Datsun stole their lunch. From 1986 to 1991…

In this blog:

1. Don’t get fooled again – the grubby facts within private equity / credit.

2. Can you name this?

3. UK – what Reeves is blatantly avoiding discussing.

4. If you think you know better than Buffett.

In this blog:

Things Go Better with Coke

The Magic of Dividend Compounding

Not Just Coca-Cola - Berkshire's Dividend Empire

In this blog:

Buffett on gold

The budget – will she, won’t she?

China and involution – bigger may be a lot more dangerous.

One way to retire with friends

Gordon Brown, and now Ms Reeves?

“Private credit defaults” – cockroaches? It’s US sub prime again

Perfect dip buying.

The market crash: it’s coming, read this.

Tariffs – things ain’t what they seem

Getting your head around your age

The bit of your wealth that’s missing.

Avoid the folly of the crowd

In this blog:

1. No commission or ketchup: be a customer not the product.

2. Fidelity’s Magellan Fund, 29.2% annual return from 1977 to 1990 (from $20m to $14bn)

3. What to expect: outsourcing your key income decisions.

4. This pension paid the beneficiaries for 135 years: how long do you need yours?

In this blog:

1. Just how bad can your provider be? From pension co to Swiss private bank

2. “Even God can’t beat pound/cost averaging (“This is the last article you will ever need to read on market timing”)

3. “We should never be so old as merely to watch games instead of playing them”. Like food? Have you ever eaten this sandwich?

In this blog:

1. GDPR – sorry, you can’t read it, it’s GDPR chum

2. Buy low sell high: current underlying index criteria that should make any investor think.

In this blog:

1. A recording of a real client conversation: it’ll amuse you.

2. All your tax free allowances – use them to generate £16,000+ tax free.

3. Hey you, don’t watch that watch this…

4. So you think you understand pensions? Try this.

In this blog:

1. How the wealthy – very wealthy – spend their money.

2. The £XXXk pension mistake most people never spot.

3. Personal wealth – not about picking funds

4. From the Wall Street Journal – how to choose a financial adviser

5. Tax-smart income: minimising HMRC’s share.

In this blog:

1. The anxiety we deal with.

2. The most common pension mistakes made by DIY investors.

3. Buffet: the fallacy of great fund managers.

4. When you probably do need an adviser.

5. How to tell the difference between cost and value.

In this blog:

1. Ageing: from Slush Puppies to a Glenfarclas, Bluey to the Old Man and the Sea, a Bullworker to a Garmin watch – things change.

2. MSCI World, 10- year annual returns – 14.5% or 0.9% for exactly the same investment.

3. Why the FT wrote about Chancery Lane

4. The data on gold – should you?

In this blog:

1. Gilt ladders – how they work, and the giant downside.

2. Did you ‘beat the market?’

3. Is your income increasing or decreasing? Know the right question to ask.

4. Sweden – flat pack pensions, really.

In this blog:

1. Are we normal?

2. The influence of behavioural economics on personal pensions

3. Investment decisions: How much people save

4. Asset allocation: How people invest

5. Income drawdown: How people spend in retirement.

In this blog:

1. S&P500 – like Tiffany it’s expensive though is it value for money?

2. It’s not about the money: a grown up in America

3. The Pension Revolution: Doug Brodie & George Aliferis live on YouTube

4. All the way from America: What’s the best withdrawal strategy in retirement?

In this blog:

1. Gulf Oil and the 500% dividend.

2. How to leave $8m in your will.

3. Yes, you are paying more tax.

4. “Forever young” – the problem with DIY investing.

5. If Buffet and Munger were partners, how come Warren got all the wealth?

6. You might not need us, here’s a wider used alternative.

In this blog:

1. Are investment trusts better than tracker funds?

2. A comparison table showcasing top-performing UK investment trusts and tracker funds, detailing their total returns over 1, 5, 10 years, along with their ongoing charges.

3. People study this: What do you need to be happy in retirement? How many items in this checklist do you still need to work on? (Alternatively, have your spouse fill yours out for you).

In this blog:

1. What ChatGPT says you need to retire.

2. $2.41 billion – the interest that the US pays on its debt every single day (including Sundays).

3. Lifting the lid – a quick look at a technical tool we use (warning: it involves ratios).

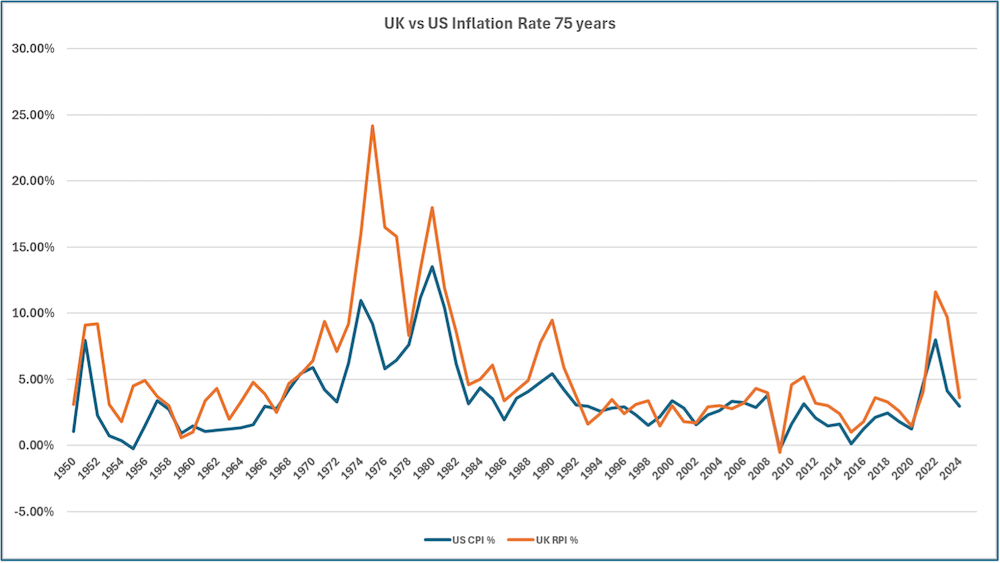

4. Vietnam, inflation and the real biggest risk you have as a retiree investor.

In this blog:

1. How the US owes China money.

2. What is the your severity of failure?

3. Were you born at the right time to invest your pension?

4. People rarely do what they plan – the stats from the Society of Actuaries.

5. M&S vs The Entire Cybercrime Ecosystem.