Yes, but...

by Doug Brodie

/1. The single biggest error

I started my training in the finance industry on May 10th 1989; since then there have been numerous corrections, crashes, catastrophes and collapses in the investment markets. As a result of the dotcom or credit crunch crises we amended our investment strategies, quite deliberately to protect retirement money from such falls in value. We run these strategies for our clients every day, we research, test, amend, question and compare the data generated by these strategies every working day of the year, and yet…

In 2020 a client was convinced that China was about to implode, governments were colluding, the notes from his boss’s broker about impending demise were accurate so he pulled everything to cash, in April. As we had the portfolio records we revalued the holdings in December and calculated that by selling to cash at the bottom he had lost himself £400,000 in cash.

In 2016 we had the Brexit vote and the outcome scared the market down 15% within the next four weeks. Mr ‘I’ve always invested my own money’ had only just finished the first six months of investing with us, so his final phase had only just been made. Rejecting our advice he sold all, and created for himself a £200,000 loss, being 20% of the £1m that we had organised in a tax protected shelter for him to fund his retirement.

The worst decisions are made by over-confident, educated men, those who are simply unable to take advice. Our strategies, you’ll know, are simply based on data – we have no funds, contracts or products of any kind of our own, so where the data leads, we follow. (Our 2024 white paper is at the printers as we speak). Historical income data is in fact a good indicator of future income, and that’s because most income is either contractual (gilts and bonds) or pre-funded (investment trusts).

There are plenty of DIY outlets available online, they are much cheaper to use than our firm as they are off-the-shelf suppliers of products; you can buy tomatoes at Waitrose, or you could have had them ready-made in gazpacho de bogavante at El Bulli. If you want all the trimmings, there’s more involved.

/2. The second biggest error

Don’t fiddle.

You may not have any work to fill in your days now, however picking over investments on a daily basis will only generate unease and anxiety. More so now we have a new, Labour government, whose arrival has been accompanied by a torrent of ‘what if?’ tax scares across the media. I am never bored of this simple chart:

It is from our learned sage Simon Evan-Cook, it is the FTSE in 2020 – all three lines are the FTSE, it’s just that A shows daily movements, B shows monthly movements and C is annual. Every investor ended up in the same place. The daily charts are only relevant to day traders – you’re not, we’re not. If the market falls 1% today we do nothing, it’s not relevant.

Don’t get distracted. The people making these errors are those spending their days in front of screens when they should be painting, fixing things, cooking, reading, writing, playing pickleball or squash, in the gym, volunteering or sight-seeing.

/3. Morgan Stanley and the 10% correction

It’s not us, it’s them.

The head of US equity strategy for Morgan Stanley, Mike Wilson, has told an industry web group via Bloomberg that there are technical market reasons for the US market to fall by 10%, and that correction is getting closer. Armchair investors are blinded by the headlines created from the tech stock outperformances, the Magnificent 7.

However, the correction will come from the index, not the big stocks, as it is the average US firms that are missing their earnings forecasts. As they have said, it’s ‘the other 490 companies that are not doing well’. The reality Wilson pointed out is that there is probably a Nifty Fifty (again) who are doing well, however it is a true 90 that is suffering, failing in their projections and in desperate need of the Fed to cut interest rates deeply so that consumers and businesses have more disposable income.

The difference is stark – this is the Big Companies in the S&P 500, versus the Main Street companies represented by the Russell 2000. Mr Wilson was quite right.

Last point on this, there are those who answer ‘buy low, sell high’ with ‘yes but…’. That’s an error.

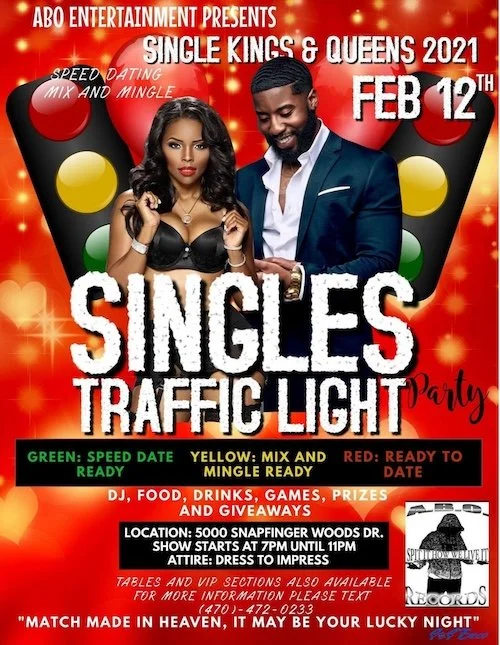

/4. Speed dating (with JP Morgan)

[Thank God I’m too old for this, Ed].

You’ll be reassured to know the JP Morgan event was at 8.30 in the morning, in their offices, and with HICL, Schroders, BH Macro and BlackRock, the four of them pitching specific funds and trusts. This was an excellent event as JPM had its own in-house multi-asset team there as well, and they were looking for their own reasons to invest in their model portfolio:

Schroders were promoting their Japanese investment trust, and one of the charts that stood out was the detail of the relative value of listed firms on the Topix, relative to 1x ‘book’ value. This is not an expensive market, more so compared to the US.

Moving on to BlackRock World Mining, you’ll often hear copper being discussed whenever any starts discussing miners as a sector, and for the last two decades that has been based on the meteoric rise of China – cabling up the country from power plants to Mr Yang’s two bed flat. Now that property craze has come to a juddering halt, why has copper not collapsed? The answer is very simply put in a chart: