The yield has climbed to 10%

by Doug Brodie

/1. The client who got 10%.

This is the email I received yesterday:

Hi Doug,

>> I noticed that for my longest held SIPP the YTC (yield to cost) climbed to 10% today.

>> This is for monthly investments (and the occasional lump sum) since 2012. I stopped investing in about 2020. The capital growth is far harder to calculate and I don't have the data. Mind you nor do HL, who do not offer any tools to see this kind of analysis.

>> The yield to the current value is 5.11%

>> I thought I would mention it - thanks to your advice and work. The figures are modest, but the percentages are impressive.

Thanks – Ian.

I replied:

Hi Ian – do you mean the portfolio as a whole or just one of the trusts?

From Ian:

Sorry, I wasn’t clear. It’s across the whole portfolio – City, Dunedin, Edinburgh, Claverhouse, Law Debenture, L&G, Merchants and the two Murrays. The overall yield to cost has climbed to 10%. It keeps climbing. You’re right about the long game.

Note: this client is a mathematician and a physicist so he understands the nature of compounding.

/2. And another client who emailed yesterday.

We handle £200 million of enquiries managing £150 million across 11 different platforms with 47 different fund managers – there’s an upside in our firm being independent, the downside is the admin time and cost. Sometimes a ball will be dropped, though we are always available, the average length of experience in this industry for our staff is 26 years, when things don’t go to plan we’ll sort it out, no fuss, no drama. This client had a rough time with a previous firm as it sold out just as the client himself had sold his business:

Hi Doug,

Many thanks for your email…,

Funny that you should mention 2017 because that was the year that I sold my business. By July 2017 I had moved both of our SIPPs and a portion of our ISAs to our then financial consultants xxx limited. We placed no further SIPP or ISA money with them after that date and only took drawings to cover normal outgoings as we had capital in our Hargreaves Lansdown ISAs as well as in savings accounts.

Actual capital values of our combined SIPPs and ISAs with the financial consultants were as follows:

13.07.2017: £986,276

16.07.2019: £958,396

12.07.2021: £944.621

April 2023: £748,391 (transferred values from xxx to Chancery Lane, to which separate ISA funds from Hargreaves Lansdown were added).

So no, there was no triumphant growth figure to boast about, merely a massive loss of value after the xxx business was sold in early 2021 to what became the XYZ group, which was an amalgam of businesses that had been bought and they simply didn’t have the staff to cope with the greatly enlarged business following several acquisitions. We were allocated a Financial Planner who appeared overworked and undertrained. It was a dreadful period during which answers were few but smoke and mirrors aplenty!

Hence my concerns about apparent transparency, although perhaps a touch unfairly in your case. It is true that your team and you have kept us informed every step of the way, for which I am most grateful. I just wish that we had come across you sooner!

Best wishes,

W.

/3. How systemic risk drives a tank through total return strategies.

We have just completed the 2024 edition of our core white paper, Rational Income Investing. All our research is based on data collation and analysis – the past may not be an accurate indicator of future profits but it’s much more accurate than crystal ball gazing.

We have published this research paper since 2019, this year’s paper is the fifth-anniversary edition. To date, we have tracked the numbers with a start date for investment of 1986, one of the reasons being that we want to ensure the period covers all types of market behaviours. This year’s data we switched to a flat twenty years, being directly aligned with the pension income period of most people. The differences between the success rates of the two periods are stark as you can see below.

This is the chart of a £100k investment using only the HSBC FTSE 100 Tracker fund, drawing down 4% of the fund at the end of each year for income. The measure was to see how well it performed the task of delivering income at or above the first year (£100k x 4%) of £4,000 – in only 4 of the 24 years did it succeed.

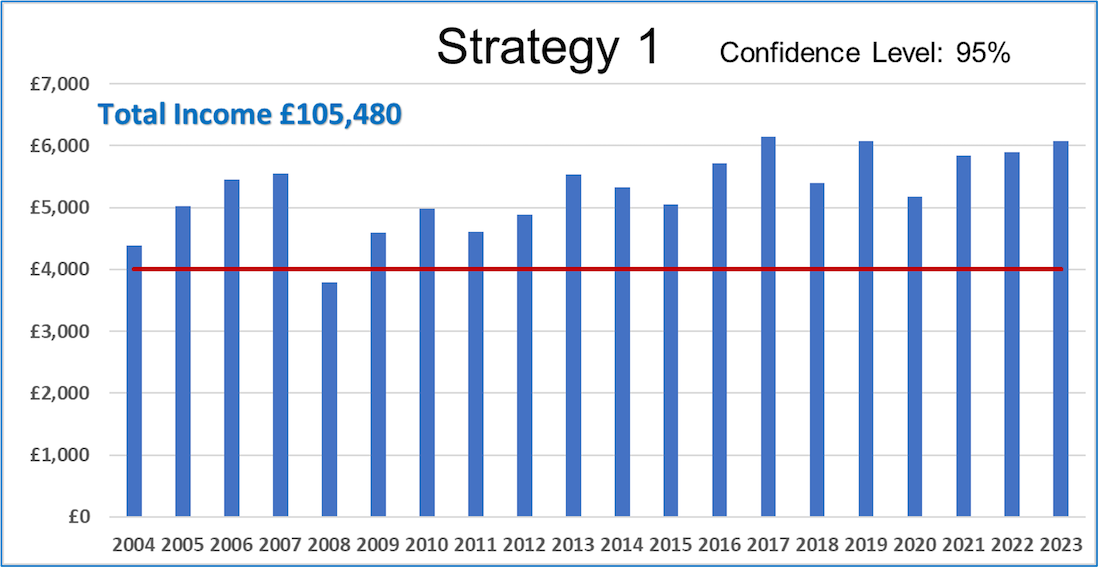

Switch that scenario to run from 2004 and we found an entirely different scenario:

The reason is simple to see on a chart – the initial market falls in 2000, 01, 02 collapsed the capital value so 4% of the smaller sum was less than 4% of the starting £100k. That compounded the problem for the next sixteen years.

You can’t defeat sequence risk – the only way out of the spiral is to reduce the income being drawn, and that’s the last thing a retiree wants to be faced with.

/4. An authoritative voice on the fallacy of using Monte Carlo analysis for retirement income.

The idea of flipping a coin twice, then repeating the exercise 99,999 times is, of course, ludicrous. Instead one asks a computer to do the experiment. This process is generally termed Monte Carlo Analysis, since it can be considered the simulation of a game that might be featured at the famous casino in Monte Carlo, Monaco. The term seems suitable for a coin-flipping game, but hardly so for some of the other sources of uncertainty that affect retirement income.

William F Sharpe, Stanford University, Nobel Laureate in Economics.

https://web.stanford.edu/~wfsharpe/RISMAT/

We agree. The purpose of Monte Carlo analysis is to generate a range of possible outcomes, when what retirees need is to know precisely what the income will be in any given month.

/5. Tale from the far side – one person’s personal summary of his retirement life.

It’s not all lollipops and unicorns; you have to reinvent your daily routine. Gym, volunteering, travel only go so far.

In retirement I am learning to ‘be’ rather than ‘do’.

I defended criminal cases and did other civil liberties and rights work for 45 years. I began to learn blacksmithing while I was still lawyering. I now work on one Innocence Project case and the rest of my time, I hammer hot steel.

Because I was self-employed, I retired gradually. For several years, I felt guilty about leaving the human service and liberty struggles. I know that I was no longer able to satisfy my own professional standards due to fatigue.

Blacksmithing requires spatial comprehension, judgment by eye and feel, hand-eye coordination, and aesthetic sense. Lawyering involved none of that. Nobody’s life or liberty is at stake in blacksmithing.

I greatly enjoy that I am exploring who else I can be. I have encountered artists whose outlooks are so different from criminal justice system participants. I maintain friendships in both worlds, but differences are stark.

The serendipity that occurs in artmaking, not from lack of skilled discipline but from a mysterious process, was not something that I experienced as a lawyer. All of this makes me wonder about other capacities to discover.

AG, aged 77, via the New York Times.