The universal guidepost for all financial decisions

Its not rational to risk what you have for what you don’t need

by Doug Brodie

News

Everyone knows about property. We happen to live in houses, work in offices, stay in hotels and buy things from shops. Even when we buy online our items are sent from warehouses.

Youngsters look away now.

Back in those days, the heady 80’s, you and I were at the start of our property owning years, juggling ridiculous interest rates on our interest-only mortgages, and discovering the delights of Habitat as Ikea had yet to arrive on our shores.

Abigail’s Party was over, but we were having dinners and folk over to party and drink, and the common story over the food was how much a house/flat/apartment on our road had increased by – not in percentage terms but real hard, tens of thousands of pounds.

The scary bit came with the early 90’s recession when the spectre of negative equity arrived, and dinner parties were never the same. I’m not sure quite how those high interest rates pushed up the prices but they did – perhaps it was the Big Bang in mortgage lending, when anyone could go to any lender without having to have had a savings account for a year so – not a bad discipline to reconsider?

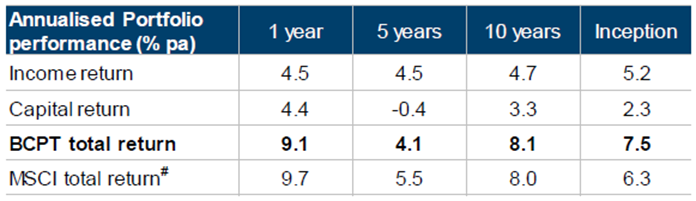

I met with the property team at Columbia Threadneedle earlier, they of the original F&C property trusts, now rebranded. These are the figures from the £1.2 billion ‘Commercial Property Trust’ portfolio (that’s the MSCI Property Index as reference).

The key figures for successful returns here are the void (empty units) rate at 6.4%, chiefly due to redevelopment, and the rent collection running at 99%.

Due to the income return you can see in the table above, property trusts are beloved of pension schemes that need income to pay their pensioners. The flip side of that ownership we saw brutally carved in September with the gilt fiasco – as pension funds had to raise cash, they sold what they could willy-nilly (I wonder if your spam filter will let that through??). The effect of that is plain to see in this table – it compares the value of the underlying properties (the NAV) to the share price, and you can see there is little if any correlation.

It must be frustrating for an investment manager to see his positive returns being completely ignored by investors who prefer to dump stock and walk away.

What has changed in this market, and what we are wary of, is the average lease length – here it is 6.8 years to expiry, and that’s not very long. Standard Life run a property fund with a minimum 15 years to expiry. We like long expiry based funds for obvious reasons – flexible work operators like WeWork are in deep trouble as their tenants can & do simply rent by the hour or the day. We prefer longevity, but as with all recipes, there are several relevant ingredients to make a good property cake.

Stats

Inflation?

Interest rates?

Growth?

Here’s the picture from the Bank of England, European Central Bank and Oxford Economics, put together by data bods at Threadneedle – pictures tend to be easier to follow than numbers.

We think they are right with how inflation is likely to pan out … to an extent. For the first time in years we have a swathe of public sector strikes (nurses even), and those settlements will embed wage-based inflation into our economy. As ever, settlements are usually being made on the basis of a bit now, more next year, then the year after, and when that happens it simply bakes in to our economy some perpetual cost increases, so we think that running inflation in our modelling scenarios is a relevant figure.

Commentary

Jeremy Hunt just stuffed the media. Well done Jeremy. His mini budget was bland, predicted and predictable, and as exciting as watching … well, take your pick. We think that was the right thing to do. Since 2016 the rest of the commercial and business world has been holding off from pumping money into the UK as they wait to see how The Big Plan for us unfolds outside of Europe. I won’t go further on the subject, you’ll get the sentiment.

The point was that the meeja and the weekend papers had cleared the decks to fill us all in on the calamities, give-aways, tax grabs et all that was hoped for in the budget. The youthful reporting team at the Saturday Telegraph couldn’t hold their breath any longer so produced the wonderful …

Err, no actually, that’s not the case, and to put everything into perspective, we replaced the headline with the actual stats, a snapshot of the extra tax that we’ll be paying. In our experience, additional rate tax payers will not be screaming for Universal Credit by having to pay a further £590 per year tax on dividends, and anyone stymied by an extra £2,600 tax on selling a property probably needs to have a rethink of relative values.

I’m no bleeding heart or red under the bed, but the £350 billion we collectively gladly took from Rishi over the pandemic has to be paid back sometime, n’est-ce pas?

Doug

For more investment tips and interesting stuff, subscribe to our emails below.