Teach your children well

by Doug Brodie

/1. Teach your children well

A wage war has broken out amongst the Magic Circle – that group of law firms who dominate corporate law. The starting salaries for newly qualified graduates is now £150,000 from several firms, and at 10 hours per day for 46 weeks per year (2,300 hours) that equals £65 per hour including lunch. At a multiple of 4x earnings, that means these trainees are likely to be being billed to client accounts at £260 per hour. Two points come to mind:

1. Are the corporate clients being made aware they are paying fees that provide sufficient cashflow to pay Miggins (minor) a salary that is 4.3x the national average as a trainee?

2. How long does Miggins (minor) foresee his/her employment with said firm – if you start at £150k when does your increased salary get so big that … As an adult with decades of real-life experience you know what happens to highly paid employees as soon as the economics get wobbly.

/2. “You think you know us?”

Can you match these people in our team to the descriptions below?

1. Jim Harrison

2. Doug Brodie

3. Kseniia Gostieva

4. Martin Vaughan

5. Jackie Baker

6. Phil Gillet

-

a. Brother holds the World Record for the Deca-Ironman – one single event being 24 mile swim followed by 1,120 cycle ride followed by 262 miles run. ("The last two and a half marathons were just physically exhausting.")

b. Was an Equity-card holding trapeze artist with Jerry Cottle’s Circus.

c. Born in a country with Pal Losonczi as ruler.

d. At peak, owned 6 tortoises at the same time.

e. Held the world record for fastest pizza delivery – New York to London on Concorde

f. Online cycles with chums in Australia at 6.30 am, and has specialist knowledge of Catherine the Great.

/3. The really very obvious investment (that stumbled)

Our chums at research firm Edison Group highlighted the following:

“Gresham House Energy Storage Fund (GRID) invests in utility-scale battery energy storage systems (BESS) in Great Britain. GRID and its peers saw sharp share price falls in H223 and early 2024, due mostly to an unexpected decline in revenues and the slower-than-expected utilisation of BESS by the UK’s Electricity System Operator.”

If you’ve read much on renewable energy you’ll have noted that a big problem is that solar and wind energy is often very productive during the day, but not so much at night. A solution is to store the excess electricity somehow, and batteries are what we know and what Elon Musk has been promoting.

It should be a very simple to understand investment, one where the market is clear and understandable and not going away. However you’d probably not attach much likelihood of ‘lower than expected’ usage by our National Grid, but that is precisely what happened. We mention this as a classic example of things that come from leftfield when you are least expecting them, and that no matter how intrinsic the value of an investment may be, it can always go wrong. Diversify – it’s a free lunch for all investors.

/4. Remember 1996?

Linda is a senior equity strategist at Federated Hermes – they have over 2,000 employees and caretake over $2 trillion so getting ‘it’ right is really quite important.

In a recent interview she was asked about whether she felt that AI had become a bubble with current valuations:

“The idea: For today, you could do a lot worse than continuing to invest in the AI theme. I was there for the internet bubble and when it burst in 2000, and I was there when Alan Greenspan talked about irrational exuberance in 1996. Some of my best research would indicate that today is about equivalent to 1996, so we’re not quite truly irrational yet. AI is not a craze — it irks me to hear people say that. It really is a revolution. There are many ways to invest in it — it’s definitely not as simple as the Magnificent Seven or Magnificent Five anymore.”

We agree. We think the excess shown in the dresses at Cannes to the valuations in parts of the market to the amount of cash held by corporates creates an impression of being a few years away from a correction. We think Nvidia is very highly value however we do note the difference between now and 1999 in the actual physical earnings of current companies, clearly shown in this chart:

/5. Why we don’t recommend total return investing for drawdown

Returns are not symmetrical. The key to longevity in your drawdown investment is to at least maintain the value of your pot even after you have drawn your income. In the last 35 years – a goodly length for a retirement – the FTSE All Share fell in 12 years out of 35, or 34% of the time. It fell in 5 of the last 10 years. The point being that when the value of your money falls, you are making it worse when you sell some of the investments to create cash to live on.

Peter has £500,000 in his pension from which he wants to draw 4% income as he’s read somewhere that’s what ‘should’ do. Peter has his pension on Interactive Lansdown, he follows the mantra that active managers cannot beat the index and that trackers provide the cheapest investment.

Peter’s worked out that £20,000 (4% x £500k) will provide him with the income he needs from that pot. Keeping with trackers he opts for a FTSE All Share fund.

This is the annual returns of the All Share index over the last ten years, alongside the Vanguard All Share unit trust Peter has read about on the web. Peter has not looked at the performance of what he’s investing in – because he is selling some of his investment every year to generate the £20,000 to withdraw (his pension), he should be aware that if the value of his pension falls then the £20k is a larger percentage than the 4% he originally planned, and the opposite is also true, if it rises his withdrawal of £20k is a lower percentage.

In the last ten years the FTSE index has fallen 5 times – 50% of the period – and in only 4 of those years did the annual return deliver the 4% he planned to draw. The Vanguard return is based on total return, so includes the income – immediately you can see income is important. However the Vanguard fund (other trackers are available) still failed to deliver the 4% he planned in 5 out of 10 years – confused, he wonders why the 4% doesn’t work?

The average annual return on the Vanguard fund was 5.73%, however that includes four barnstormer years of over c13%; the median helps disregard the outliers and that comes in at 4.44% - how stoic and disengaged is Peter that he could ignore the annual fluctuations? Technically speaking the volatility of the Vanguard returns is 10.32, however natural income cannot be negative, only positive.

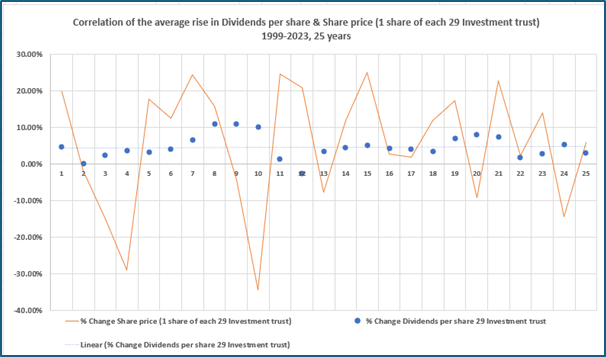

We advocate anxiety-free retirement. This picture tells the story: