What if...?

Investing through the rear mirror

by Doug Brodie

We all need a point – for many the continual focus on work means we are short of thought and detail about what happens when we do eventually have that port-work free time called retirement.

In the days of our parents’ generation, retirement was still very much centred around age 65 and final salary pensions, and in our generation that has all changed.

We have worked with people through their transition from work to ‘not work’ for over thirty years and in many cases now the step back from PAYE is replaced by stepping into part time roles or self-employed consultancy or business.

Judy Aslett was the first British female foreign correspondent when she was posted to South Africa by Sky News in 1990 (having previously done her PhD at Sussex). She started with ITN, then Channel 4, presenting, creating and training in the field of TV production. Her partner in crime is the youthful Steve Holloway, who met Judy whilst working with her as cameraman, producer and editor on foreign soils.

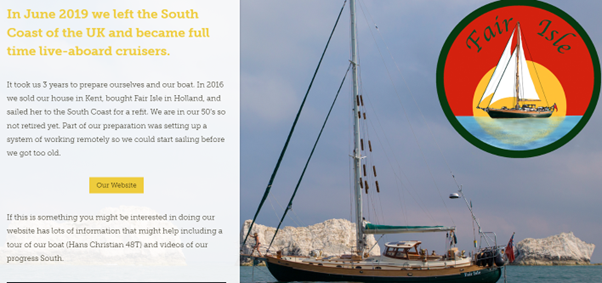

Girls grown up and flown the coop, they decided to go all in for their Third Age in a ‘no way back’ kind of way –

This is known as full time liveaboard. They sold their house to buy it, and also bought a small bolt-hole in Blighty to return to when needed, so not a complete break. The boat they bought is 48 ft long which is bags of space for a couple. Steve had been a sailor before but not Judy:

“If you’re wondering how I got Judy (a non sailor) to agree to a life on a boat the answer is we keep making films and visiting interesting places. That, and we bought a boat with a ‘proper’ bed, a shower, room for the children to visit and I agreed to head South. Phew. Eventually she was happy.”

You can read their website here: http://www.sailingfairisle.com/index.html.

The reason I am writing about Judy and Steve is because their story is much more akin to reality for you and I, when compared to others. For one, an identical boat to theirs can be bought for £135 - £150,000 which, although the price of a second home, is not out of reach of many without having to sell the family home. There are also many relevant ways to finance such boats to preserve capital.

Secondly, unlike most folk I’ve come across on liveaboards, Judy & Steve have kids and ties back to the UK so they are not spending all year every year floating around Tonga and the southern pacific ocean. Theirs is a realistic story of boat life – click below and scroll through to 10.22 for some reality:

You can look through their last three years on their YouTube channel – but beware, it can become slightly addictive. They have also written up their story online which you can access here: https://express.adobe.com/page/M2IHww8SOtf2d/?w=0_5427

What if ….?

Getting the money right

Whatever floats your boat in retirement, it’s important to remove the anxiety. Take a look at this chart:

If you wanted to pick an investment from above, most would pick the green line – why? Because it is less volatile than the others with the same returns.

In fact what you are looking at is the global stockmarket in 2020 – the blue line shows daily movements, the yellow shows monthly and the green shows the annual return. From years of experience we can verify that investors who check their investments too frequently end up nervous, anxious and making irrational, emotionally-driven errors. Please don’t do this. If you have a pension value app on your phone you should delete it – it is bad for your health and will simply unsettle your retirement for no benefit at all. Don’t do it.

How did Vanguard do?

We are independent, which means we have no ties, contracts, agreements or financial interest in any investment or manager. We use Vanguard as a tactical investment where relevant, but we don’t believe everything their marketing department publishes.

We do the double checks to ensure we are not missing anything, and to make sure our recommended strategies are the best available. When the facts change, so does our advice.

The Vanguard FTSE100 ETF has a charge of 0.09% per annum, Merchants Trust charges 0.55%, or six times as much. How did they compare last year for an investor with £100k, needing £4,000 (4%) to live on. The Vanguard ETF does pay a distribution so we have included that – we wanted to see what the capital + income position was at the end of last year, here’s the results (apologies for my ‘working spreadsheet’ format).

We’re happy with the facts as they are.