I want a sheep

by Doug Brodie

/1. “I’d rather have a sheep than a Rolex”

This is the observation made by a client yesterday, in the midst of a catch-up call. The client lived most of the adult life in the heart of the Thames Valley, riverside, rowing, Arts Committee, ‘luncheon club’, escorted art tours and a pristine, nail-clipped garden. Happy? ...not.

It’s not easy turning your life upside down post-working life, however, the client did just that – the immaculate house sold in a heartbeat, and the house in the far north of Scotland became the project. I’m sure the local tradesmen in the highland village thought Christmas had come for the whole year it took to do the work. Two things happened:

1) the client’s inbuilt always-buzzing anxiety simply disappeared, and

2) through having to source, coordinate, explain, supervise and pay tradespeople from stone cutters to curtain seamstresses, the client has more contacts, acquaintances and friends than ever in the working life. Up in a highland village, neighbours are family, you know everyone.

Happy? …so relaxed the client could fall off a chair, and from a beginning in corporate law, the most useful thing to buy now is sheep for the field outside the kitchen window. As told to me yesterday, if anyone needs to know the time, the clock’s on the church tower, what’s the point of a £50k Rolex?

What would you choose?

/2. Is £500,000 enough to retire on?

Yes. Next question please.

We’ve been helping people retire well since the late 80’s so we know the facts.

Clue: it’s not what income you have that determines what ‘enough’ is, it’s the expenses you have. I won’t quote Mr Micawber on this matter – you’ll know his line well, but I’ll wager you probably weren’t aware that in 1833 Abraham Lincoln was declared bankrupt.

Being rich doesn’t help – Lehman’s is still the largest bankruptcy at $691 billion, Walt Disney also got his maths wrong, and Elton John was bankrupt in 2002 (after spending around £1.5m per month around the year 2000/01).

/3. Tech rampant

Valuations may be sky high, however, Nvidia has been around and making money since 1993. The dotcom collaps-ees were pretty much all newbies, like boo.com, without actual revenues, cashflows, balance sheets, pretty much nothing but optimistic shareholders.

For this reason, we’re pretty sure there will be a pullback on valuations, but not a dotcom rout because these are real companies with real, embedded revenues and profits – Nvidia, Apple, Microsoft, Amazon – you might wonder about Tesla but, though way over-hyped and over-priced, its revenue for the year to the end of March 2024 was pennies short of $95 billion.

/4. Same toys, different prices

In one of our meeting rooms, there’s a Dinky toy Ferrari 156 – you know, the shark nose F1 car. I bought it last year because it was my single favourite toy when I was 8. Last year I paid £24 for it (don’t worry, I can afford it and haven’t told my wife). I have no idea what the price was in 1967 the point being that affordability now is very different to then.

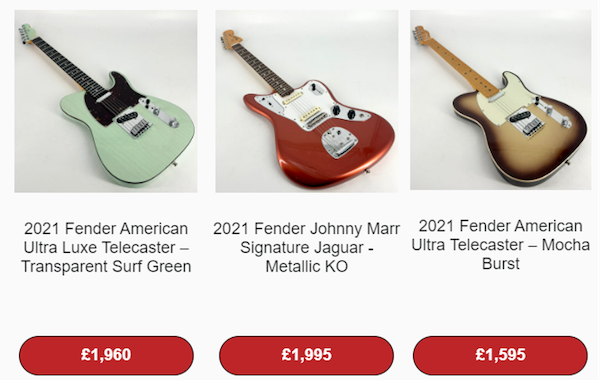

Back in the late 60’s – early 70’s a Fender Stratocaster would set you back $259 + import duty – and 5% extra if you wanted a custom colour. Today the products are the same it’s just the prices that have changed. The sample below is what you and I could buy one for today, though if you wanted an original 1966 in 3-tone Sunburst you’d be paying around £22,500 – now that’s inflation.

/5. Here she comes, just a-walking down the street

We don’t think Rachel Reeves is singing ‘do-wah diddy, diddy dum, diddy do’.

What she said was: we’ll review pensions.

Over the past 35 years we’ve had all the pension rumours you could think of, however this time, with our readership having (in the main) fully funded pensions with imminent plans, it might be a good idea to secure your PCLS – the tax free cash. That is not advice to do anything but talk to us if you think Labour’s pension plans might affect you. And we don’t know, Sir Keir doesn’t keep us in the loop either.