Beating inflation

Baby boomers know about inflation, today’s 60 year old hit teenage years when the price of his Spirograph was shooting up in price by 24%. Spikes always occur, however from 1970 to 1980 the average of the annual inflation rates was 13.3%. Yikes.

At an average of 13.3% per year, over ten years the value of £100 changed to £350 – remember that inflation increasing the cost of a brick by 350% is also increasing its value by 350%. The buyer has to pay more, and the seller makes more.

I remember our detached family house in Glasgow as being huge (you do when you’re 11), and oddly I also remember from somewhere that is cost £16,000 in 1971. Then the 70’s came, and the property investment my parents owned leapt in value, whereas the cost stayed at the £16,000 they had paid.

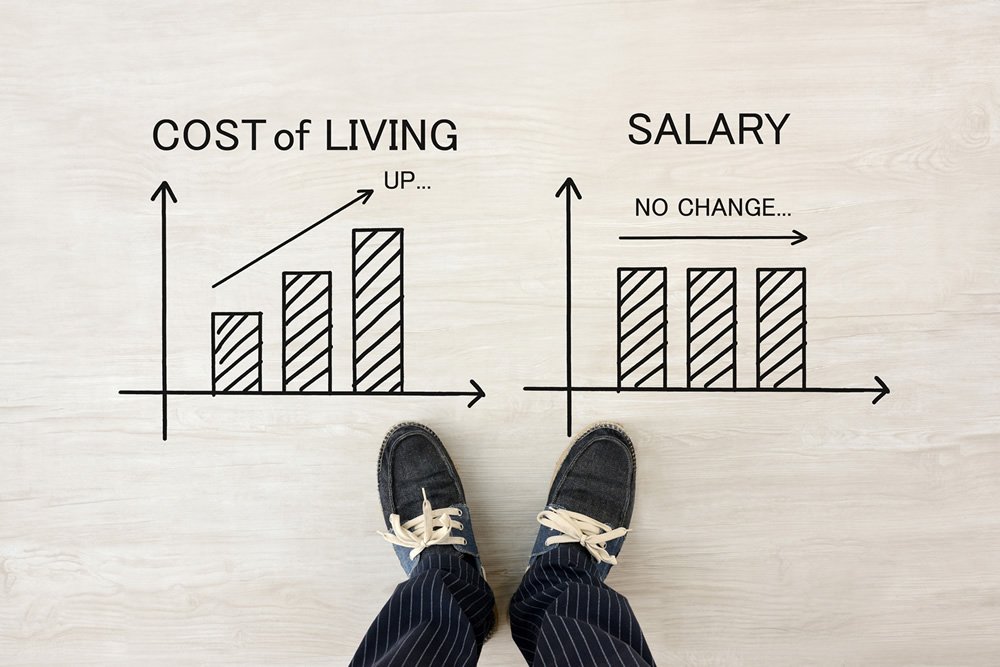

Inflation increases the value of things as well as the costs; the assets you have bought pre-inflation should show good returns simply because inflation has pushed up the replacement cost. People buying during periods of high inflation are those that suffer, not least because salaries react to price inflation, so there is a lag until the paycheque can cover the increased costs. That’s why high fuel costs in 2022 is extremely harsh – firstly the workforce incomes have not kept up with increased costs, and secondly the fuel, gas and electricity are not bought in advance, in low inflation times, so consumers have to pay full whack as the prices jump.

There will always be spikes – inflation is not a calendar item, it is a measurement over a rolling twelve month period, so last months figure is very unlikely to be the same as next months. Plus, don’t forget the annual figure is measured from twelve months ago, so when oil fell below zero cost, we were always going to get a huge oil inflation figure twelve months later.

Inflation is a measure of the price of ‘stuff’ – you’ll have read about the ‘price basket’, but did you know there are around 230 items in the basket, and it is the change in price of those items over the past twelve months that is measured. Diesel and electricity you know about, you might not know of dehydrated noodles, protein powder, leggings or washing machine repairs.

Retirement should always last an age, so your retirement income needs to grow so that in ten years’ time, your lifestyle remains affordable. We deal with this head on by researching income assets that have shown great ability to deliver above inflation rises measured over rolling five year periods.

You can see for yourself in our tools how successful our portfolios have been in beating inflation, year by year, over the past thirty two years.