Afraid of Ms Reeves? A simple cut to tax on interest and investment gains

by Doug Brodie

In this blog:

/1. Afraid of Ms Reeves? A simple cut to tax on interest and investment gains

/2. Just one thing about your pension

/4. From the £900 million Merchants Trust – where they are finding income

/5. It's cooking on gas (or riding at ‘full gas’ as the cyclists say)

/6. “Doesn’t play well with others”

/7. The right thing at the right time

/1. Afraid of Ms Reeves? A simple cut to tax on interest and investment gains.

ISAs and pensions are the best tax wrappers for most of us; back in the day there was also a worthwhile capital gains tax exemption but that’s basically been cancelled by various chancellors. Those holding long term cash or investments can also use an additional tax wrapper known as an investment bond. These are often ‘sold’ by banks (Barclays) and insurance companies (Prudential), and can be commission-loaded by direct sales firms (St James Place). However, on the ‘wholesale’ side of the industry, they are very effective tax tools as they guarantee a reduction in the top rates of income tax.

These would only really be relevant for sums of £250k and above, being left for at least three years (lifetime is better). They work brilliantly with cash deposits or with investment portfolios (just like an ISA), and as long term income tools – if this is you, then get in touch. Bonds can be complex, they can be dangerous in inexperienced hands, and they are non-contentious.

For a UK resident, 40% income tax is cut to 36%, and 45% income tax is cut to 40%. Basic rate tax doesn’t change, and gains are subject to income tax, not CGT.

Income tax is only assessed on withdrawals, not on accrued gains as the money grows.

By way of example, Transact is an industry insurer for the adviser sector – their clients’ cash balances get interest at 4.74% variable, fixed term deposits are available from 3 months (4.5%) to 3 years (3.9%).

For a 45% tax payer that means the equivalent gross interest from a bank account would be 5.47%.

There’s no initial charge, on £1m the annual charge is 0.056% per quarter, above £5m that falls to just 0.0125% per quarter.

You can hold any mainstream investment asset – cash, shares, funds, investment trusts.

/2. Just one thing about your pension

There’s a saying that to find the true answer you have to ask the same question five times; in short this means we have to be very clear about we are asking, what our objective is. The story below demonstrates this wonderful, the old lady got precisely what she wanted:

This old lady handed her bank card to the teller and said “I would like to withdraw $10”.

The teller told her “for withdrawals less than $100, please use the ATM. The old lady wanted to know why... The teller returned her bank card and irritably told her “these are the rules, please leave if there is no further matter. There is a line of customers behind you”.

The old lady remained silent for a few seconds and handed her card back to the teller and said “Please help me withdraw all the money I have.” The teller was astonished when he checked the account balance. He nodded his head, leaned down and respectfully told her “You have $300,000 in your account but the bank doesn’t have that much cash currently. Could you make an appointment and come back again tomorrow?”

The old lady then asked how much she could withdraw immediately. The teller told her any amount up to $3,000. “Well please let me have $3,000 now.” The teller kindly handed over $3,000, very friendly and with a smile to her. The old lady put $10 in her purse and asked the teller to deposit $2,990 back into her account.

Absolute clarity about what she wanted.

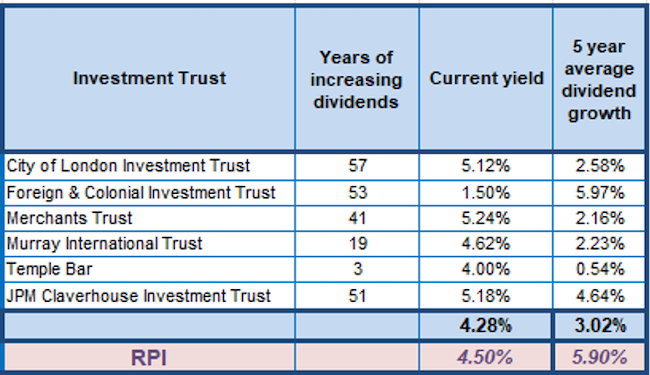

/3. Because there’s no plan B

We are primarily financial planners: the process is that we work out with our clients the amount of income that is needed then liability match that lifestyle cost with income from assets. Because we do this all day, every day the income generation is relatively straightforward for us – the in depth work is helping clarify precisely what income is needed, what capital sums are likely to be needed and when, and likely changes through life. This takes time, we don’t deal in off the shelf products, the 1.2% yield from F&C may be very relevant for some whilst the 6.8% in prefs might be needed for others.

There are some things in life that are better if they are right first time – as a regulated advisory firm we are very responsible and liable for the outcomes for our clients. This means we tend to be cautious and to focus on certainties (sometimes guarantees where needed), and it’s all totally transparent which creates a problem. Most people take capital as being the determinant of how much income they will get, however, that’s only true at outset. Income from investments is not correlated to capital as the chart below clearly shows:

The blue bars show the share prices of a diversified portfolio each discrete year, the red line shows the income. This isn’t alchemy – the dividends are paid per share, irrespective of what the price is of that share. Dividends are paid (normally) four times per year, set by the board of directors, whereas the share prices change every minute of the trading day, set by anonymous buyers and sellers.

/4. From the £900 million Merchants Trust – where they are finding income

Many of our clients hold Merchants Trust: its objective is long term rising income and our analysis clarifies that it does precisely what it says on the tin. Run by the highly experienced Simon Gergel and his team, it has increased its dividend every year for the last forty-two years. The current dividend is 28.4p, this morning’s share price is £5.82 so the yield for someone buying today is 4.87%. For those who bought the trust in 2020 and paid £3.60 they get exactly the same dividend so their yield is 7.88%. In addition, to underpin that dividend it holds revenue reserves of 18.1p – 63% cover.

/5. It's cooking on gas (or riding at ‘full gas’ as the cyclists say)

As an income investment, its net asset total return annualised over the past 3, 5 and 10 years outstrips the FTSE All Share, and that’s the validity of Simon Gergel’s expertise and consistency. With his process it’s not a case of ‘yield and nothing else’: the chart below shows that there is an auditable record of higher annual returns from high versus low dividend US stocks.

/6. “Doesn’t play well with others”

Chancery Lane Research is our wholly owned subsidiary that undertakes all our research – it tends to stand alone in the playground at break, and doesn’t follow the group. The marketing departments of companies like Allianz (which runs Merchants) are paid to highlight all the positives, however, our role is to be sceptical and do our own auditing. In this area, directly advising clients on an advisory basis, we are unique. This is a snip of part of our analysis tool for Merchants:

The revenue reserve was severely dented in 2020, and that was directly in line with the fall in income in that period from £36 million to £25 million; that’s the whole point of the revenue reserve. Its use to support the dividend should not be seen as a negative but rather as confirmation that everything is working as it should. What is more important is the trend, what is showing over time:

This is a Ronseal trust – it does what it says on the tin.

The Merchants Trust PLC has, for many years, focused on a simple proposition: to deliver a high and rising income together with capital growth, through a policy of investing mainly in higher-yielding large UK companies. We measure our success in attaining this objective by comparing the performance of the portfolio against the performance of the FTSE All-Share Index.

/7. The right thing at the right time

If it’s a $3.5 trillion company it can only be Apple. Indeed.

A snippet from t’interweb in August showed that it wasn’t always so:

In 1997, Apple was just 90 days away from bankruptcy before a $150 million investment from its rival, Bill Gates and Microsoft, saved the company. Fast forward to today, Apple is the world’s most valuable company, worth over $3 trillion. This August marks the 27th anniversary of one of the most strategic and unlikely business bailouts in history—one that transformed the tech landscape forever.

Bill Gates took the view that Microsoft had to have a creditable, competent rival, for various reasons including anti-trust legislation. I have no idea if they cashed out their shareholding or still own it, it’s interesting to note that canny as he must be, Bill Gates clearly saw Steve Jobs as a visionary who could deliver. (And that was when $150 million was real money).

/8. Pension issues – global not local

Pensioners clashing with police?

Perish the thought, but let’s see what Ms Reeves comes up with, let’s not be too hasty.

/9. Opinions versus data

We didn’t stumble on our investing methodology, it was born out of the continued failure of unit linked funds and investment firms to deliver reliable investment returns. Basically, this was and remains due to the mandate of the investment manager to run the fund, not to run your money. It’s like they operate a motorway, 1,000 miles long – it’s not for you, it’s for anyone who wants to use a part of it at any time. They run the motorway, they don’t tell you the best way to get to where you’re going, indeed they don’t want to know your destination because that’s nothing to do with their job.

If you’re in London and want to go to Milton Keynes you can use the M1 – but you need to remember to get off at junction 13. Or should you use the A5 instead? Or the M1 to Dunstable and then the A5? The people who built the M1 don’t care, it’s not their responsibility, and so it is with ‘XYZ Asset Managers Equity Fund’ – they don’t you, they don’t know what you need and they take no responsibility for your investment success. With income it’s even more pertinent because with your retirement income, there is no Plan B, it has to be right first time. Like heading out on the M1 to get to a wedding by 3 pm on the Saturday afternoon – it has to be right first time.

The pension income equivalent of telling you the best route to get from St Albans to Beddgelert is this type of information:

There’s a lot of drum banging and flag waving about ‘cheap = best investment’ however, it’s the data behind this chart that shows why UK index investing is not good for stress-free, boringly reliable pension income:

If we were to tell you our opinion of Merchants trust, we would basically have to convince you that our opinion is correct, whereas what we actually prefer to do is simply collate and visualise the data. With reference to the FTSE chart above, this is how the Merchants’ data pans out: same capital volatility, however a gently, consistently rising income.

/10. Last word goes to Peter Jay

Peter Jay died last Sunday at 87. Former economics editor of the Times, British Ambassador to Washington.

BBC - Charming, brilliant and arrogant in equal measure, he was famously described at school as "the cleverest young man in England". (Note: that school was Mr Sunak’s alma mater, Winchester).

He suffered fools badly, and saw his articles as part of a high-minded battle of ideas.

A sub editor once dared to complain that one piece was difficult to understand.

I only wrote this for three people", came the lofty reply. "The editor of the Times, the Chancellor of the Exchequer and the Governor of the Bank of England.