11% interest: don't get eaten by the angler fish

How to get rich slowly and avoid the puddles

by Doug Brodie

The hullabaloo over gilts has had a knock-on effect with interest rates, and you’ll have noticed that interestingly large rates are now being advertised. We should probably repeat ‘if it looks too good to be true …’, and an easy litmus test is to check what the bellwether Nationwide is offering. Their 1 year fixed rate deposit is 4%, so anyone offering multiples of that is doing something with your money that is not what you think.

The angler fish uses a lure from its head to attract prey, which it then devours. That is precisely what offerors of ultra-high interest rates do, as they know some prey will take the bait.

A good example is currently available from Mr Google:

This is an advert from the direct-to-consumer execution only platform Interactive Investor, which has retained the much respected Ian Cowie to write periodic pieces.

The google ad fishes with two items: a) 11%, and b) Ian Cowie.

To give the man his due, in the very first paragraph on his story he does say the 11% is “… for the very brave investor – arguably verging on bonkers.”

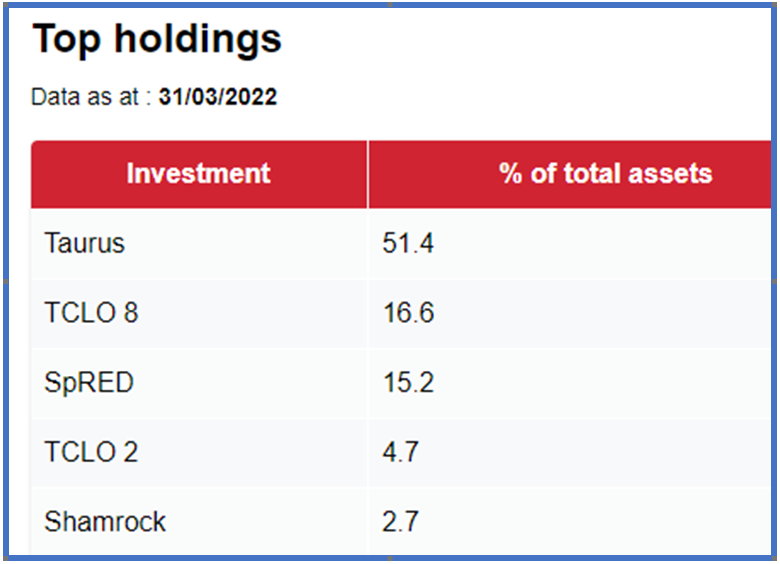

I had an enquirer recently seek comment on his existing portfolio, pointing out that he was currently with a yield of 11%, that now has gone to 14%. Clearly that’s not cash, and it’s not an interest rate – it’s a yield. Chenavari Toro is an investment trust, operating in a sector we do not use – structured finance. This is the sector that collapsed the world’s banking system in 2008, which shows what happens when they get it wrong. Toro’s main investment portfolio is:

We have never heard of any of these, which is no surprise to us because structured finance is often simply packaged loans made to private companies and private equity funds. You’ll remember Northern Rock, but you’ve probably never heard of Granite – a securitisation master trust that held most of its assets. Toro invests in things like Granite, and its written objective is:

“To deliver an absolute return primarily investing and trading in ABS and other structured credit investments in liquid markets, and investing in asset backed transactions including through the origination of credit portfolios.”

Toro isn’t really an anglerfish because it’s not interested in the retail market – it is constructed for institutions that understand precisely the assets it holds and need exposure for their own reasons. Two simple reasons why retail, retirement investors would not find this suitable:

it states that it can gear (borrow) at up to 130% of assets (meaning it can owe more than it owns, in 2021 gearing was 96.63%), and

it holds no revenue reserves so dividends can only be paid from each year’s profit.

AIG was one of less than 10 AAA companies in the world when it fell off a cliff in October 2008. We were retained as advisers to over 1,250 investors with more £1.5bn in AIG whose money was locked in – and those investors didn’t have a clue about why or what their money was invested in, they had simply jumped into the interest rate being offered. And discovered the puddles.

It takes time

Interest is an amount of pre-determined return calculated per fixe £unit of investment. Yield is a distributed return calculated by reference to the underlying value.

£100 in the bank at 2% interest is a £2 payment, and the £100 remains constant.

A dividend is set in £sd, it is then described as a % yield to the underlying share price

Toro’s last 12 months dividend was 7.3p.

When declared the share price was 53p so yield (7.3/53) was 13%

Share price today is 51p so that same dividend is a yield of (7.3/51) = 14.3%

Your yield as in investor is dictated by the price you pay for the investment, not today’s market price.

Witan’s last 12 months dividends were 5.68p, today’s share price is 219p so current yield is 2.6%.

An investor who bought his/her shares thirty months ago paid circa 150p for those very same shares, so the current dividend of 5.68p for him/her is a 3.78% yield.

An investor who bought those same shares when all was gloom and doom in 2009 paid circa 63p – so with the identical ‘Witan Ordinary shares’ which each earned 5.68p his/her yield is 9.01%.

Few retail investors understand the consequence of a dividend being declared as a cash sum per share, and nothing whatsoever to do with the share price. When that penny does eventually sink in pension drawdown becomes much more relaxing.

For more retirement planning tips, thoughts, news specifically for our generation, subscribe to our emails below.